The segment of the solar industry that’s shown the most activity and interest over the past few years

has been “storage.” We’ve received a lot of interest in this subject, and that makes sense. There are thousands of residential solar systems installed in the past 10 years, and the owners want to explore the option of adding battery backup for times when the grid is down and that expensive solar system on the roof is also down with it. Adding to the discussion are some very interesting new financial opportunities – particularly in Maryland. But in addition to the money, there are important things about storage you need to know (so please keep reading).

Major Financial Incentives for Battery System Owners

There’s good news for solar owners: the IRS recently ruled that adding batteries to your system does qualify for the federal tax credit . There had been some disagreement on this issue, but this ruling seems to take care of that on the federal side.

But if you’re a Maryland resident, the news gets even better. The Maryland Energy Administration (MEA) recently announced a 2018 Energy Storage Tax Credit Program. The potential amount available for storage is as follows (whichever is less):

- $5,000 for a residential property;

- or$75,000 for a commercial property;

- or 30% of the total costs for installing the storage system

Throw in the 30% federal tax credit for storage, and your savings add up to as much as 60% of the parts and installation labor cost of your new battery storage system.

This is a great opportunity for both residential and commercial solar users in Maryland. But one key thing to keep in mind is that the available amount is finite: The original amount set aside for residential was $225,000.00. As of May 11, 2018, there was $184,883.20 still available for residential tax credits, and $525,000 available for commercial tax credits. This is a first come, first served opportunity, so give us a call or click here if you’d like a quote and to get in the queue as soon as possible

Make sure you know enough about storage. (And that your installer does.)

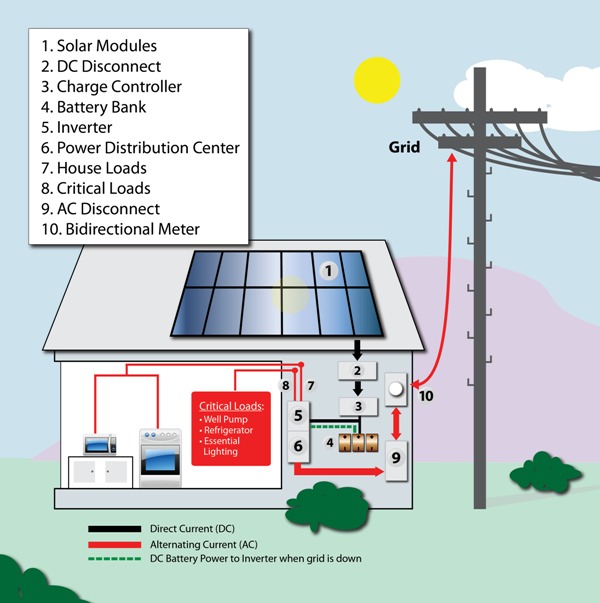

Solar systems with storage cover a fairly wide spectrum. You have solar systems with a battery backup capability that significantly engages only when the grid goes down. You have solar systems that employ a configuration that offers backup power and also operates in a “consumptive mode”at night to reduce or completely offset the need to buy power from the grid on most days. And you have fully off-grid systems that have no grid connection whatever, with the property’s entire electric system based on a battery bank and its supporting solar array and charge controlling system.

The very key point for off-grid is that your available power is totally finite, so you’d better have a good handle on your daily loads and a solar/battery system professionally designed to meet that anticipated loads number.

Like most things solar, there are new storage products hitting the market all the time. New battery technologies come and go, and consumers are faced with trying to sort out the wheat from the chaff. This is particularly hard when they are confronted with supposed “facts” from solar installation companies who, in many cases, have really limited technical understanding of how the battery chemistries work and the pros and cons of different battery systems. I know this from seeing installations and proposals from companies that are clearly using customer installations for on-the-job training.

We’ve been installing solar with battery backup and off-grid solar systems since 2009, and I believe that during those years we’ve installed more solar systems with battery banks than anyone else in the four-state region. Some of our battery systems are now 9 years old and show no obvious sign of degradation.

The only way to confirm this would be with formal load testing, but we see no reason for that until some sign of a problem.

Systems we Recommend

We currently recommend and install the following battery systems:

- Solar with Battery backup: Sealed AGM batteries from DEKA USA

- Off-Grid Solar: Sealed Gel Batteries from DEKA USA

- Consumptive Solar Systems: As long as we have net metering, a consumptive configuration on your battery system makes no sense. Yes, you can offset some loads by going to a time-of-day switchover to batteries, but you’ll have to use solar system production the next day to recharge the batteries. It’s a bit worse than a wash, because in addition to using solar system power to recharge the batteries, you’re shortening the lifecycle of your batteries.

Systems we don’t recommend

SolarEdge StorEdge system with LG batteries: This system is popular with the plug-and-play solar installation companies, but we see multiple issues with this system’s design and capability:

- Very high battery cost (compared to AGM storage)

- Very limited stored capacity (currently only 9.5 kWh useable)

- Very limited surge capability. If you have a deep well, submerged well pump (3/4 HP or more), pay attention that that factor. Well pumps don’t react well to “brown power.”

- Limited scalability (You’re restricted to the minimum and maximum solar array values that the 7600 inverter supports.) For larger arrays, you need a second inverter – which will not be part of the battery-based capability, by the way.No integrated generator connection (for long grid outages)

Note: SolarEdge recently announced a new and improved system with more storage and capacity. We’ll see.

Tesla Battery System: Has anyone ever actually received one?

Adding Batteries to Legacy Systems

Our approach for adding battery backup to a legacy system is the same as for installing a new system:

Proven technologies, proven engineering, and industry best practices followed for installation. The battery banks are AGM based batteries in metal cabinets. The batteries are protected and maintained by a fully functional AC-Coupled inverter, and the critical loads panel is designed by a professional designerin close consultation with the homeowners. (It’s their system, after all).

AC Coupling is not a perfect system, and it does require some fairly detailed planning as to the anticipated loads when the grid is down. But for legacy systems it’s the best there is at this point. We have reference installs you can talk with if you’re interested.

The segment of the solar industry that’s shown the most activity and interest over the past few years has been “storage.” We’ve received a lot of interest in this subject, and that makes sense. There are thousands of residential solar systems installed in the past 10 years, and the owners want to explore the option of adding battery backup for times when the grid is down and that expensive solar system on the roof is also down with it. Adding to the discussion are some very interesting new financial opportunities – particularly in Maryland. But in addition to the money, there are important things about storage you need to know (so please keep reading).

Major Financial Incentives for Battery System Owners

There’s good news for solar owners: the IRS recently ruled that adding batteries to your system does qualify for the federal tax credit . There had been some disagreement on this issue, but this ruling seems to take care of that on the federal side.

But if you’re a Maryland resident, the news gets even better. The Maryland Energy Administration (MEA) recently announced a 2018 Energy Storage Tax Credit Program. The potential amount available for storage is as follows (whichever is less):

- $5,000 for a residential property;

- or$75,000 for a commercial property;

- or 30% of the total costs for installing the storage system

Throw in the 30% federal tax credit for storage, and your savings add up to as much as 60% of the parts and installation labor cost of your new battery storage system.

This is a great opportunity for both residential and commercial solar users in Maryland. But one key thing to keep in mind is that the available amount is finite: The original amount set aside for residential was $225,000.00. As of May 11, 2018, there was $184,883.20 still available for residential tax credits, and $525,000 available for commercial tax credits. This is a first come, first served opportunity, so give us a call or click here if you’d like a quote and to get in the queue as soon as possible

Make sure you know enough about storage. (And that your installer does.)

Solar systems with storage cover a fairly wide spectrum. You have solar systems with a battery backup capability that significantly engages only when the grid goes down. You have solar systems that employ a configuration that offers backup power and also operates in a “consumptive mode”at night to reduce or completely offset the need to buy power from the grid on most days. And you have fully off-grid systems that have no grid connection whatever, with the property’s entire electric system based on a battery bank and its supporting solar array and charge controlling system.

The very key point for off-grid is that your available power is totally finite, so you’d better have a good handle on your daily loads and a solar/battery system professionally designed to meet that anticipated loads number.

Like most things solar, there are new storage products hitting the market all the time. New battery technologies come and go, and consumers are faced with trying to sort out the wheat from the chaff. This is particularly hard when they are confronted with supposed “facts” from solar installation companies who, in many cases, have really limited technical understanding of how the battery chemistries work and the pros and cons of different battery systems. I know this from seeing installations and proposals from companies that are clearly using customer installations for on-the-job training.

We’ve been installing solar with battery backup and off-grid solar systems since 2009, and I believe that during those years we’ve installed more solar systems with battery banks than anyone else in the four-state region. Some of our battery systems are now 9 years old and show no obvious sign of degradation.

The only way to confirm this would be with formal load testing, but we see no reason for that until some sign of a problem.

Systems we Recommend

We currently recommend and install the following battery systems:

- Solar with Battery backup: Sealed AGM batteries from DEKA USA

- Off-Grid Solar: Sealed Gel Batteries from DEKA USA

- Consumptive Solar Systems: As long as we have net metering, a consumptive configuration on your battery system makes no sense. Yes, you can offset some loads by going to a time-of-day switchover to batteries, but you’ll have to use solar system production the next day to recharge the batteries. It’s a bit worse than a wash, because in addition to using solar system power to recharge the batteries, you’re shortening the lifecycle of your batteries.

Systems we don’t recommend

SolarEdge StorEdge system with LG batteries: This system is popular with the plug-and-play solar installation companies, but we see multiple issues with this system’s design and capability:

- Very high battery cost (compared to AGM storage)

- Very limited stored capacity (currently only 9.5 kWh useable)

- Very limited surge capability. If you have a deep well, submerged well pump (3/4 HP or more), pay attention that that factor. Well pumps don’t react well to “brown power.”

- Limited scalability (You’re restricted to the minimum and maximum solar array values that the 7600 inverter supports.) For larger arrays, you need a second inverter – which will not be part of the battery-based capability, by the way.No integrated generator connection (for long grid outages)

Note: SolarEdge recently announced a new and improved system with more storage and capacity. We’ll see.

Tesla Battery System: Has anyone ever actually received one?

Adding Batteries to Legacy Systems

Our approach for adding battery backup to a legacy system is the same as for installing a new system:

Proven technologies, proven engineering, and industry best practices followed for installation. The battery banks are AGM based batteries in metal cabinets. The batteries are protected and maintained by a fully functional AC-Coupled inverter, and the critical loads panel is designed by a professional designerin close consultation with the homeowners. (It’s their system, after all).

AC Coupling is not a perfect system, and it does require some fairly detailed planning as to the anticipated loads when the grid is down. But for legacy systems it’s the best there is at this point. We have reference installs you can talk with if you’re interested.